Dear Friends, AoA

Lately, there has been a debate on changes in the SBP’s Act. Under the IMF program, central bank’s autonomy is one of the check lists. Government has wasted no time in agreeing to 1) increase in electricity tariff 2) kick-starting privatisation 3) SBP’s Autonomy bill. Central bank’s actions - or lack thereof - are always center of attention.

Central Bank’s textbook definition of independence means freedom of monetary policy makers from direct political & governmental influence in the conduct of policy. Period. Central Bank can have two models;

1) Operational arm of government financial policy: functions determined by technocratic policy makers to supplement government goals to nudging credit in priority industries, spur growth for electoral gains & set policy guided by political actors

2) Independent authority: tasked with specific tasks, such as, inflation control, financial stability and/or currency management.

The latter - independent - model is what is advocated by the IMF in Pakistan thesedays. Naturally, skeptics are rife if the SBP should be independent enough to make growth as a tertiary objective. Little is the realization that for any “sustainable growth (tertiary)”, “financial stability (secondary)” is a must.

SBP’s revised task-list: Monetary policy hardly beats inflation in Pakistan

Proposed objectives of SBP under the recent bill:

Primary objective: Domestic price stability

Secondary objective: Financial stability

Tertiary objective: Support government’s economy policy

If your author had it his way, he would have rather preferred hierarchy differently; Financial Stability (primary), government policy (secondary) & price stability (primary). In Pakistan, inflation is usually a product of commodity-flation, supply side shocks, rising import prices & exchange rate shocks.

Check SBP Bill’s Salient Features on Ministry website

Accountability vs over-accountability:

However, more contentious is the issue of accountability. The good news is that SBP would be more actively answerable to the Parliament (global best practices). However, the teething issue is that NAB/FIA or other agencies would not be able to hold SBP members accountable. This is indemnity.

While we can argue that bureaucracy or public office holders are generally wary of harassment/overly skeptical agency and thus, have a pens down or “no work no complain” attitude. In those cases, ability to work with free mind is necessary. In contrast, with no fear of doing things wrong - invariably, all human beings do err - might create a feeling of being above the law.

An independent central bank could have avoided “boom(s)-and-bust(s)”

Under Musharaf’s tail period, oil prices were roaring upwards propelling currency depreciation from Rs 60 to Rs 80 in 2008-9, that led to inflation. Similarly, overvalued currency caused Rs to fall from 105 to 155 in 2017-2021 today against the USD.

Notice the similarity; Balance of Payment crises. It can be presumed hypothetically if an independent central bank was alive in those periods, monetary tightening would have occurred earlier than politicians wanted & currency would have found its equilibrium before precipitating a need for hard landing.

In addition, politicians splurge money for electoral gains before elections even when the government doesn’t have taxes collection. This money printing is inflationary in nature as money supply increases to chase same products. Had there been a relatively independent central bank to say “no, we can’t print for you, sir! you better widen your tax base and spend within your means”, Pakistan most definitely would have had lesser debt & better tax collections.

Such is the kind of good independence. The pitfall of overly independent central bank could be policy settings completely bereft of long term political objectives. Growth is politician’s or finance ministry’s headache. Period.

Level of Central Banks’ independence - Turkey vs China

If the policy makers are so refined & have an absolute game plan, they can tweak monetary policy to their looking without hurting financial stability. People’s Bank of China (PBOC) is one example of semi-independent central bank. That’s a good example. Let’s look at bad example of political interference.

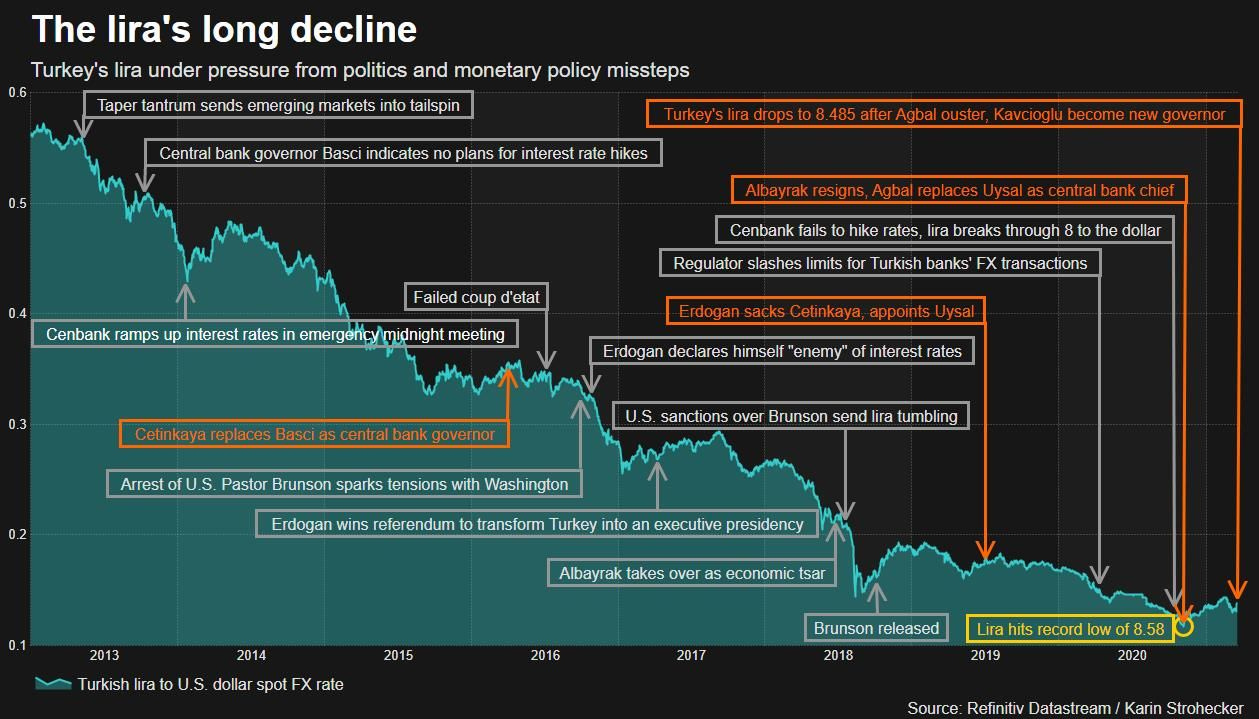

Turkey.

Being a central bank governor in Turkey is not an easy task. Erdogan’s policy is pro growth and anti monetary tightening. Successive changes in the bank have eroded investors confidence. Creating a depreciating spiral that doesn’t end. There is a consequence of political interference. India’s Prime Minister Narendar Modi probably didn’t want such high level of independence in the time of Raghuram Rajan (India’s Reza Baqir) nor Urjit Patel.

Turkey’s economy was developed enough to have exportable surplus but such meddling in Pakistan would cost a political future & an irreversible slide. Had there been an independent central bank, PkR could have been higher, boom-and-busts could have been avoided & stock market would have had higher Price to Earning, Debt levels could have been lower & tax collection could have been better has government wouldn’t bank on SBP to print notes to feed the needs. Thus, your author believes central bank should be independent but accountable.

“A state that cannot engage in fiscal and monetary policy may be an impotent leviathan at the mercy of populist challengers.”

To Read SBP’s Reza Baqir views: watch from 41 minutes

Please share your views.

Reading Material:

https://www.bloomberg.com/quicktake/central-bank-independence?sref=YnT9KH2s

https://www.cato.org/cato-journal/winter-2020/fresh-look-central-bank-independence

https://www.omfif.org/2021/02/in-the-line-of-fire/

https://www.imf.org/external/pubs/ft/wp/wp98126.pdf

https://doc-research.org/2019/03/central-bank-independence-economic-growth/

https://www.imf.org/external/pubs/ft/wp/2008/wp08119.pdf

http://documents1.worldbank.org/curated/en/422091611242015974/pdf/Does-Central-Bank-Independence-Increase-Inequality.pdf

I agree. The SBP can not be a challenger nor all-in channel for fiscal policy. You rightly note the Balance of Payment crises. This begs the question of how to define financial and price stability. 1) Targeting exchange rate volatility against a basket of currencies of the largest trade partners would be a more specific mandate. 2) Developing the capital markets through a phased approach promoting uniform platforms, transparency, electronic access, international investment, for all market segments, including debt markets, would go a long way. That could be a much more specific financial stability mandate.

5 year plans are not always communist/socialist. Let the SBP be accountable to its own stated plans within its mandate. After all, private enterprises often have 3 to 5 year strategies, with executive management accountable to a Board of Directors and regulators.

Best,

Haris