IMF & Pakistan - Reforms delayed, is prosperity denied!

Power mess & low taxation can collapse the economy.

IMF is a doctor full of medicines ($). Usually, the patients (countries short of $) knock the doors in times of severe distress. Apart from strict diet control (avoiding expenditures, increasing taxes & reducing losses), patients are still advised to remain prudent in self-medication. A promise that many break conveniently. Thanks to short-sightedness of the politicians. Pakistan’s case is no different. In fact, an award winning case-study.

After clubbing most reviews, Pakistan secured $500m from IMF last month. Hurriedly, the country successfully floated Eurobonds worth $2.5b (including a 30 year note). Expectations are rife with another $1-1.5b Sukkuk, $500m Eurobond & ADB/WB’s financing to the rescue well. Very frankly, our currency reserves now are in a semi-comfortable range to focus on the key economic issues. It’s time to solve the problems & not just focus on the next election. Government is in a fix.

Prime Minister Imran Khan has hinted to secure another “package” from IMF to address the menace of covid 19. Speculations are rife that the third wave would be equally severe in Pakistan as the first wave was. Of course, there has to be a fundamental reasoning behind going for another round of borrowing. Your author believes there is no urgent need for extra $ from the IMF. Yes, the loans are cheap but we’re at the cusp of getting addicted once again without going through the rehab (structural reforms).

Global policy makers are divided as well. On one hand, there is a pressing need to bail-out countries, delay austerity & support growth to battle the fallout of Covid-19. Hence, IMF is debating another whopping $650b SDR allocation to support global recovery. And world bank is calling for prolonged debt-freeze. Is IMF showing easier access to the funding - in times of ultra low interest rates - as a true empathetic lender or to further advance geo-political mileage. Former is seldom ever true. Thus, Pakistani authorities must not over borrow again just to buy time for painful reforms.

In it’s latest assessment of Pakistan, IMF’s document has some salient features:

(https://www.imf.org/en/Publications/CR/Issues/2021/04/08/Pakistan-Second-Third-Fourth-and-Fifth-Reviews-Under-the-Extended-Arrangement-Under-the-50344?cid=em-COM-123-42918)

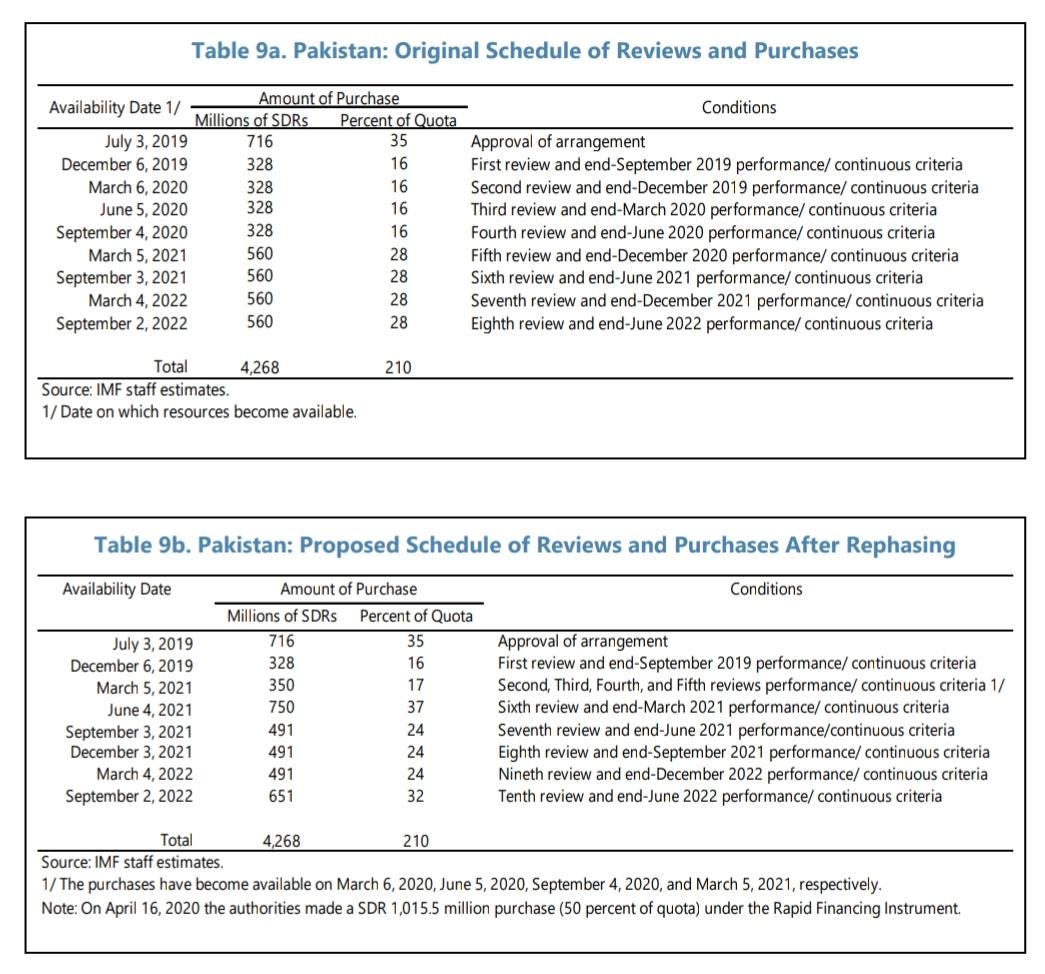

Payment Schedule: Tranche’s amounts have been changed while overall bailout package remains same.

Growth: GDP growth to increase to 4% next year, gradually nudging upwards to 5%. There is no real economic blue print of how it would be achieved. A mere ballpark figure that it “should be achieved”.

Current Account Deficit (CAD): The much hyped CAD is expected to be $1.8-2% for next two years. There seems to be an obvious error here as the import growth would explode with current low interest rates & currency stability. Import growth from energy, food, machinery, raw material & consumption will outstrip export growth. Right now the remittances growth & lower import of services is keeping numbers sustainable - it will not last. One commendable source of $ is Roshan Digital Accounts yielding $2-2.5b per year for sure. That has given Balance of Payment an unexpected support. Innovation at its best.

Taxes & Sales Tax reforms: Synchronization of Sales Tax between provincial & federal governments. Businesses are already navigating through piles of paperwork. Ease of doing business is needed for sure.

Income Tax rate slabs are going to get lesser; the higher the income more the taxes. Instead of going after the untaxed, the salaried class would be taxed higher. That’s fine only IF almost everyone is in the tax next. Hence, progressive tax rates are the way forward but not in a country like Pakistan where widening of tax-base is important. In addition, tax credits/allowances would be reduced by 50% as well that might reduce benefits for tax-filers as well.

Structural benchmarks: A new to-do list has been included as part of the plan that involves track-and-trace for tobacco products (improved documentation), more transparency, IPPs first payment by May & energy reform plan.

No Export-led growth: This is most disappointing to see that IMF’s projections have not shown any tangible growth in Exports. If Pakistan is setting the benchmark too low - despite the supposed fear of IMF - the policy makers would not be pushed to work harder for double digit Export growth. The promise of a sustainable job-creating Export-led growth seems to be dimmed. Internally, commerce ministry should not settle for less. As can be seen in the picture below, growth in remittances is expected to be higher than growth. Exports are expected to go from $23b to 29b in FY25. Meanwhile, Remittances are expected to grow $24b to $31b. That’s clearly not what the objective should be. We are heading for another boom-and-bust otherwise.

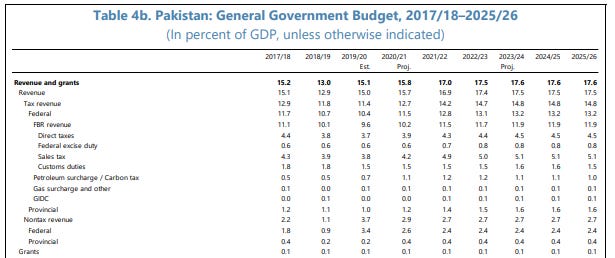

Lower Tax-to-GDP ratio: Despite the hue and cry on whopping taxes to be imposed in the recent budget, on a broader perspective increasing Tax to GDP ratio from 10.4% in 2019 to 13.2% in 2023 is a bare minimum. Again, the ratio is plateauing afterwards. Does that mean that we should stop working harder and settle at 13%? Absolutely not. The problem is that government might be once again going after indirect taxes (easier fix) and avoiding tougher but needed reforms to nab the undocumented citizens.

Remittances & FDI dependency: Similarly, there is no clear mechanism on how to increase FDI from $2.1b to $5.4b in FY25 unless government has sovereign commitments from China/Saudia Arab in the form of Refinery, SEZs, Gwadar & industrial relocation etc. It is doable but no blue prints are to be found. Whereas, in our neighboring countries, top global companies are already expanding their foot prints. A vibrant ridiculing middle-class is a prerequisite to attract the investors.

Monetary Policy: Expect monetary policy committee to provide support to growth & target “gradual” & “measured” increase in interest rates to target inflation of 5-7%. Similarly, exchange rate movements should be volatile to avoid creating BoP imbalances & avert another boom & bust cycle. Interest rates would only increase 1) once the recovery becomes entrenched 2) economy returns towards full capacity.

Budget Deficit & Primary Surplus: Budget Deficit & Primary Surplus: Budget Deficit is expected to fall near 3% of GDP in medium term while Primary Surplus is projected near 1.6% of GDP. That’s imprudent & prepared out of haste. It’s perfectly alright to have a 0.5-0.75% primary surplus provided the extra money is spent on 1) Education 2) Healthcare 3) Infrastructure 4) R&D. Of course, IMF is not heading the cabinet. That’s the job of politicians but absence of real reforms is disappointing & govt must not follow it blindly either. The quest to increase Tax to GDP ratio must never end. Don’t settle with 12-14% nominal tax growth. Has to be 15% or above on YoY basis. Period.

Crux of the document

If you didn’t understand the above technicalities, that’s alright. What you need to know is that IMF lends money & is primarily interested in carrying out reforms that help the borrower payback & remain sustainable. In this case, IMF has lowered tax target than agreed previously. Nor is it pushing for fast Export growth (it’s not their stake either). Neither is IMF advising clear cut policy measures to widen the tax base. That’s the job of the 6th chairman of FBR in 2.5 years.

However, all of this is subjective now. If the government is going back to IMF for another package. And if IMF agrees to it, considers these plans subjective. Your author feels taking more dollar loans is not necessary. Electricity tariff needs to be increased but compensated with targeted direct cash subsidy for the poor. Government has to focus on reforming the economic shape for its own future. This is our country, our people & our future. Reforms delayed, is prosperity denied.