Pakistan's $2.5b bond sale & PkR's ascent to Rs 151/$

Rising currency, FX reserves & investor confidence

Dear Readers, AoA

Pakistan returned to the Global debt markets after 3.5 years. In the process, Pakistan has had 1) BoP crises 2) Stock market crash 3) PTI’s election victory 4) IMF program (after a delay) 5) currency plunge from Rs 105 to Rs 168 6) Covid-19 and 7) sharp economic rebound. It truly has been a journey from boom to a bust. Hence, the debt issuance was closely watched. The details are as follows;

Yield:

5yr: 6.00%

10yr: 7.375%

30yr: 8.875%

Size:

5yr: $1b

10yr: $1b

30yr: $500m

The yields are better than initial guidance but higher than market expectations. Nonetheless, it’s a bold, necessary & confidence boosting to tap the markets again & beef up the reserves. US 10 year bond yields 1.75% vs Pakistan’s 7.375% implies a 5.625% risk premium. That’s usually the range (5-6%) we expect.

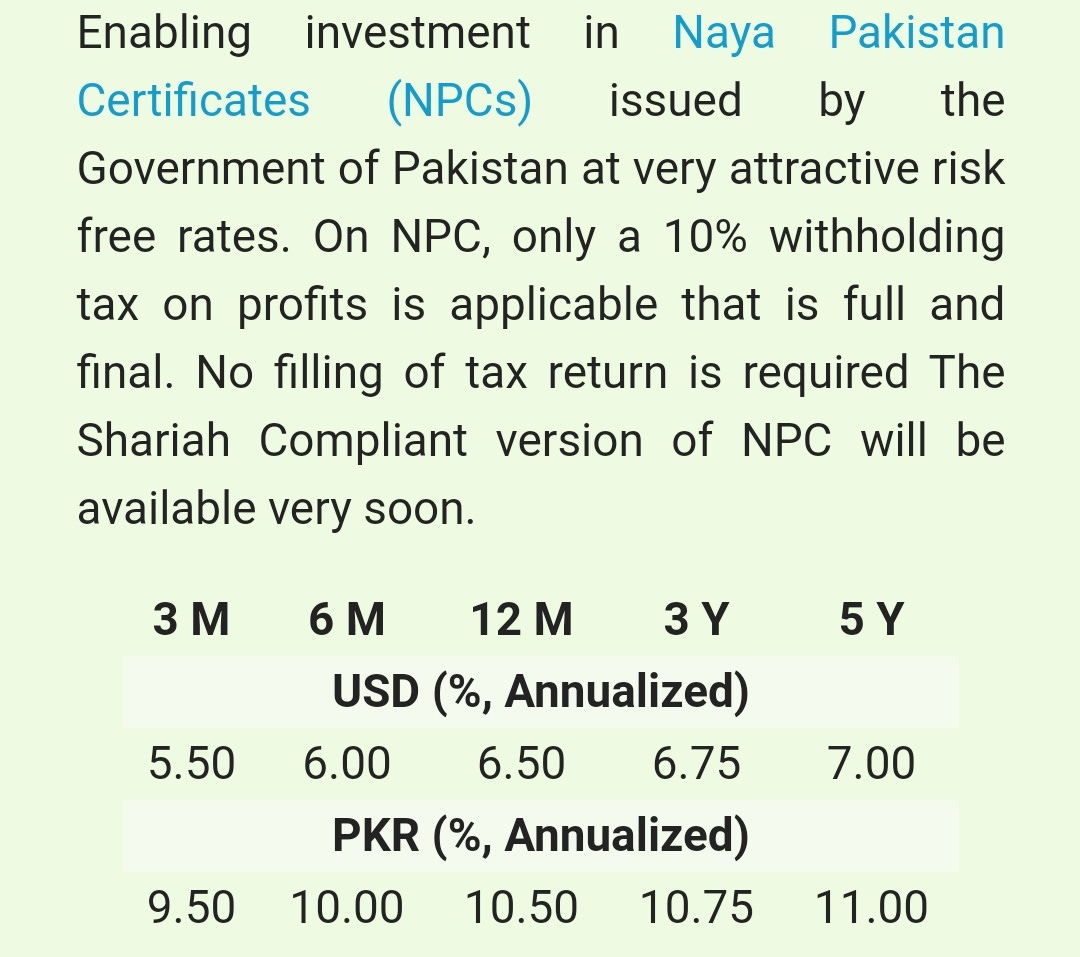

Time to change NPC yields? Too early, must eventually.

In comparison with Naya Pakistan Certificates, these are cheaper yields; 5 Year’s 7% on NPC vs 6% on Eurobond. Although it is too early, but eventually government may need to taper off the yields on Naya Pakistan Certificates by 25-50bps. Well, even if we don’t there is a decent probability that this money might come back to Pakistan. So all’s good. NPCs should be encouraged as market is yet to peak & they are getting wide acceptance among overseas Pakistanis.

What’s behind the PkR rise? Remittances, RDAs & low imports

That’s a million dollar question. Or probably more. Pakistan has never experiences such two way swings in the currency market. SBP - under Dr Reza Baqir - has been experimented market-determined currency. Not a free-float but a managed float. After the out-break of covid, Pakistan’s FX fortunes had brightened.

Remittances: In 8 months of FY21, remittances are up massive 24% to $18.7 vs $15.1. The YoY growth in any month has never been less than 14% and touched as high at 36%. This formal channel flow is a sustainable phenomenon on the back of a) low travel b) more documentation c) job losses. In the near term, amid third- wave induced lockdown, growth is expected and FY might clock in $27b. SBP’s recent venture to reduce banking transaction cost to $5-9 would also keep a tap on formal channels to send dollars back.

Low travel/imports: Similarly, demand for dollars in local market is lesser as economy hasn’t fully recovered to enable people to travel frequently for work, leisure or pilgrimages. Spending holidays abroad - or a quick trip to Dubai - is not much of a “vacation” experience itself. Thus, the local markets are oversupplied. In addition, people haven’t really been able to spend as they would like locally that may induce imports demand, except Automobile. When the GDP grows 4% we would see marked rise in imports as RLNG, TERF & growth induced imports galore.

Roshan Digital Accounts: In a low-yield world, RDA’s have become a blessing in disguise for overseas Pakistanis investors. Amount worth $671m has already been clocked in. And the run-rate for last 2 months have been $150-160/month. At this pace, Pakistan has innovated a permanent $2.5-$3b source of USD inflows. That’s impressive, to say the least & should be encouraged & promoted.

It’s raining $5.1b dollars. This too shall pass?

Read the $2.5b Eurobond news in conjunction with $300m ADB loan, $1.3b from from World Bank , $500m Green Bond & IMF’s $500m inflows. The cumulatively expected sum of $5.1b will provide sufficient ground to the policy makers to plan ahead without worrying about the currency.

The recent flurry of dollars should be squandered away in consumption but should be kept as shields for external buffers. Focus should entirely be on exports, Foreign Direct Investment (FDI) & import substitution. Policy makers should be ready to shift gears - increase interest rates & let currency depreciation - when (not if) CAD goes beyond $6-7bn (2% of GDP).

Until then, one less worry for the government so far. It’s time to focus on more impeding issues; widen tax, reduce power losses, reform SOEs & grow exports. There is no short cut to success. GDP growth of anything less than 5% is a debt-trap for Pakistan. Accelerate higher.

Thank you for reading.

Please share your feedback.