Before we dwell into the “glorious” history of our economic eras of 1960s, it’s very important to accept the reality. Especially, if the reality is absolutely not so pretty. Amid several problems country is facing - poverty, inflation, taxation, trade balance, education, health, justice etc - the one that needs no complacency is the “Debt Titanic”.

For those raised in Pakistan, they would be familiar with the following;

“Chadar dekh kar pair phelao”

(Live within your means)"

If only our policy makers had been constantly reminded of this and had shunned taking unsustainable amount of debt for electoral gains & “make it tough for the next PM” mantra. At the end, people have had to pay the price. Politicians wealth/balance sheets would have not suffered at all.

Source: https://www.brecorder.com/news/40081590/fm-tough-decisions-come-calling

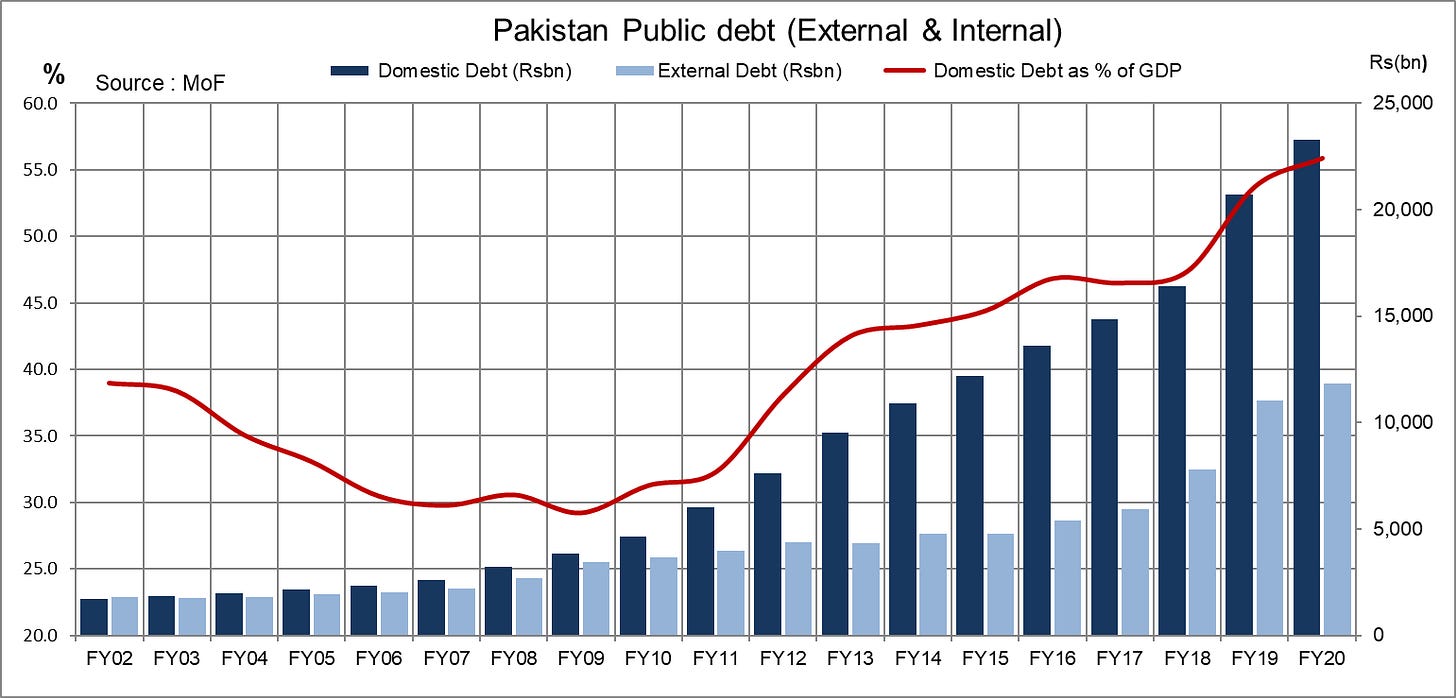

Study the graph deeply. If the readers recall, first two years of the Musharaf Era were not at all rosy. It’s only after the side we picked after being asked “with or without us” that the flows of liquidity & accessibility improved the financial well being of the country. Stable currency, firm regime, technocratic government, global growth & US support was handy.

This picture is half complete. As we do not have External Debt in the picture. Nonetheless, it’s obvious that our financial health has continued to deteriorate. At best, stabilized between Fiscal Year 2015-7.

How will we pay the debts?

Reduce excessive current expenditure: Full marks to the current government for reducing - or trying - to reduce the administrative expenses. Prime Minister often repeats the expense of his house, foreign visits etc. Symbolic but less than a dot.

Increase Taxation: Despite the (initial) willingness, government hasn’t succeeded in materially increasing the tax base. The resistance on CNIC condition was pretty strong. Only to be worsened by the Covid-19. Of course, government has to support ailing industries but policies should be in place for the future. It does feel that tax revenues would start improving now as the economy is in the growth phase.

Avoid loans “too hot to handle”: Yes, we need to borrow & we should. But there must be a) check on the limits b) incentive to widen tax revenues c) policies to grow the economy without fueling debt.

Pop the circular debt: Pakistan has actually pioneered the ever-bothering, never-ending & snow-balling menace of “Circular Debt”. The stock & flow has spiraled for a decade on various excuses; $100 oil prices, PPP’s subsidy, PML N’s expensive IPPs contract, Covid-19, Discos losses, rising Capacity charges etc. Nonetheless, it’s going up & up to a point where it can totally jolt the system. If reducing T&Ds & theft causes you political damage then go for it. It’s a matter of national economic security. House needs to be fixed.

There is a growing feeling - exacerbated by the PM’s latest comments to seek another IMF’s package to fight third wave - that complacency might kick in. No tangible growth in Tax revenues is seen nor is there a material decline in Power Sector infamous Circular Debt.

We see the intent more, but less results. Perhaps government’s hands are tied due to electoral pressures creeping in now as half of the innings is over. If we don’t deleverage - reduce the loans - we are heading for a disaster. It’s time today to plan for 2021-2026.

Debts are to be paid (Even Lannister’s from Games of Thrones did). Don’t kick the can down the road. If PTI were to be re-elected, they will be faced with the same dilemma.

Uski (Status quo parties) wo janay ussay paas-e-wafa (long-term vision) tha key na tha.

Tum (PTI) apni taraf say nibhatay (reform) kartay jatay.