Petroleum Levy - $4b question!

a) benefit lower/middle class

b) make rich pay higher tax

c) use these revenues for Education/Health

d) create a database of your citizen

e) do not let rich benefit at the expense of poor

f) improve trust % use technology for governance

A Rs 30/liter cash back on Petrol for eligible ones:

- Everyone on Ehsaas Directory

- Widows, orphans & people over +60

- Quota of 20 liters/month for Urban & 15 for Rural

- Real-time cash back in bank

- Rs 1/liter cash back to Fuel station

- OMCs to launch via loyalty cards

Disqualify those with:

- salary > Rs 75,000

- house/plots worth Rs 3m on their name

- > 1 vehicle on their name

- >Rs 500,000 in bank account

- owning 1000-1200cc cars

- owning credit cards

- electricity bills >Rs 20,000 month

- Phone bill >Rs 2,500

- international travel

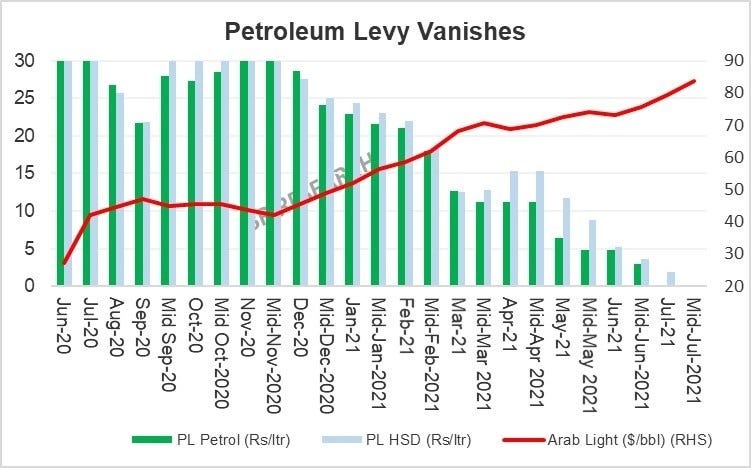

Firstly, price Petrol & Diesel fully. Diesel should be taxed more heavily to deter consumption owing to environmental concerns. Say, start charging Rs 30/liter PDL on both across the country.

Now introduce a targeted, weekly, digital, QR code enabled, Fuel cards backed scheme.

Credit: Business Recorder

Under tremendous political pressure, PTI is trying to;

- hoping Oil prices fall globally

- reduce indirect taxes

- keep energy/electricity costs low

- protect the lower/middle class

- give incentives using digitisation

- broaden tax revenues/meet the tax targets!

Instead of blanket tax, use technology and be smart. Pakistan’s low tax to gdp ratio will never create space for major human development measures. You got to improvise & find alternative, innovative & digital ways of governance. It's not easy but again, a few Rs bn are worth it if they can create a fairer society & reduce income inequality.