Time to launch "Tikka/Biryani" Rupee-denominated global bonds - investors want spice.

Foreigners buying $103m worth of Rupee-denominated PIBs in March 2021.

Dear Readers, AoA

For those who don’t understand financial technicalities, governments usually borrow money to pay for expenditures, such as, interest payment, salaries, health, defence, pensions etc. Almost invariably, tax revenues & Foreign Direct Investment (FDI) - “mehnat ki kamai” - are lesser than the expenses. Thus, money is borrowed by “issuing certificates (bonds)”; a promise to pay you back money with interest (profit). That’s how it works.

The week was abuzz with Pakistan raising $2.5b dollar-denominated Eurobonds at somewhat okay-ish rates. Foreigners bought them happily. Even the 30-year old notes attracted interests (“log bilkul jeetey hain teri zulf key sar honey tak”). It is reported that the demand was higher among European investors probably because of lower rates vs the US counterparts.

Source: https://www.linkedin.com/feed/update/urn:li:activity:6783342304733237249/

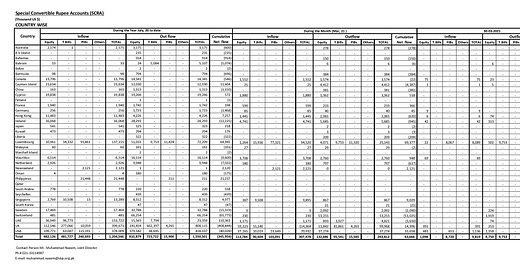

Similarly, a more interesting development is that foreign investors have bought ~$103m Rupee-denominated Pakistan Investment Bonds (PIBs) in the month of March 2021. The Rupee yields vary b/w 9.3%-10.3% per year, depending on the tenure of investment.

Given the recently issued Eurobond's USD yield of 6% (5yr) & 7.4% (10Yrs), implied currency depreciation is 3.1-3.3% for foreign investors. This is much better than 5-6% annual depreciation usually assumed given the Interest Rate Parity (IRP) theory. That’s a positive sign.

Source: https://www.sbp.org.pk/ecodata/SCRA.pdf

Tikka/Biryani (Rupee-linked) bonds will be cheaper

Sovereigns generally issue fancy-named bonds such as, Masala (Rupee), Dim-sum (Remnibi), Baklava (Lira), Panda (Remnibi) and what not. If there were a similar bond from Pakistan - it has to be a “Biryani” or “Tikka” bond. Sounds funny? Think about it.

Foreign investors are already showing decent interest in Rupee-denominated PIBs due to a) IMF’s program b) fiscal prudence c) hopes of structural reforms d) rising FX reserves e) global low yields f) manageable trade deficits. These reforms - reshaping of the economy - have to continue until we have a sustainable 5-6% growth, supported by tax-collection & export growth. The benefits are aplenty;

Lesser costs: when local & foreign investors chase same sovereign bonds, yields get lower and bargaining power increases.

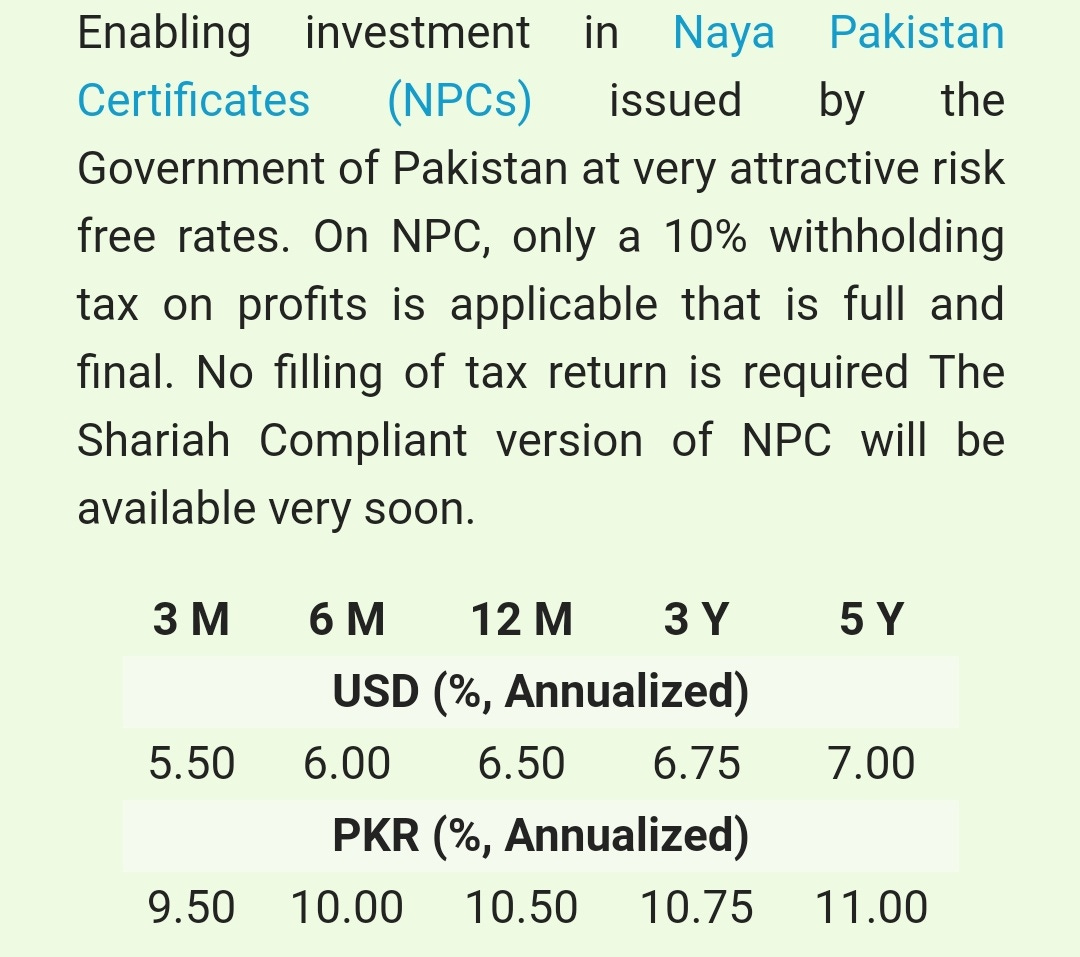

Cheaper than Naya Pakistan Certificates (NPCs): Govt is offering higher PkR yields to overseas Pakistanis via NPCs. Foreigners via SCRA are happy to buy it at 9.3%-10.3%, lesser than NPCs’ yields of 10.75% & 11% for 3 & 5 years, respectively.

https://www.sbp.org.pk/NPC-/page-npc.html

Potential Savings: => Borrowing : Rs 155b ($1b). Interest Saving: Rs 1.55b/year (1% cheaper vs NPC’s yields). Use that money to fund start-ups/housing loans.

Lower exchange risks: in times of currency depreciation, it’s better to have foreign loans in Rupees than USD.

Banks to lend to private sector: Banks have a job to do - lend to private sector borrowers - that economy needs badly. Crowding them out would prompt Banks to look for quality private borrowers.

Reduce $ borrowing costs: when foreign investors are happy to buy rupee denominated bonds, the yields for dollar-denominated bonds should also decline as overall credit worthiness improves.

Enhance Rupee’s acceptability: better use of Rupee would enhance overall credibility of local currency thereby enabling local borrowers to borrow cheaply from local & global markets

Pakistan has already highlighted it’s plan to issue more dollar-denominated bonds; Sukkuk bond ($1-1.5b) & Green bond ($500m). Rupee-linked bond is definitely on the agenda. State Bank of Pakistan’s was critically targeted at the time of “hot capital” flowing in the country. At current yields, this capital is “cold”, sticky, confidence-boosting & cheaper.

It takes years to build trust & investor confidence. And one bad move can shake it (Hafeez Shaikh ouster?). Nonetheless, seems like stage is set. No need to raise local yields to attract top dollars. Pre-requisite of entire thesis is continued economic reforms. No complacency there. Meanwhile, it’s worth tapping the global markets with Tikka/Biryani bonds.

Thank you.

Please share your feedback.